Yves here. The lead stories in the press are about Trump’s August 1 tariff salvo, but it’s a little too soon for much in the way of analysis, as opposed to reaction. These tariffs are sure to increase inflation in the US even if some companies accept reductions in their lofty profit levels (corporate profits have been at a sky-high percentage of GDP for years). So we’ll turn to a new tool for estimating increases in living costs after a couple of hot takes on what Trump has wrought.

Just after the Trump tariff announcements, the Bureau of Labor Statistics released its jobs report, and it was a doozy. Not only was the headline number, a mere 73,000 new jobs markedly lower than expectations, and an increase in unemployment to 4.2%, which is not all that bad. But when you look under the hood, it’s much worse. From Bloomberg:

Rosenberg of BlackRock says the revisions show a “dramatically different picture” now when you look at the past three months. Before these numbers, the three-month average for payroll gains was 150,000. With the revisions for May and June and the new July figure, the three-month average is now 35,000. That’s entirely different.

Oh, and the reason for the big initial overstatement and then the revisions? The so-called birth-death models, which estimates employment growth resulting from new business creation. Those who were following the econoblogosphere in the runup to the financial crisis will recall Barry Ritholtz, Michael Shelock, and then-luminaries who are no longer posting regularly assailing the birth-death model results to be greatly exaggerated, among other reasons due to big falls in construction, and on a scale to distort the overall results.

And even before the jobs data hit the wires, some economists were stressing that the tariff increases would hurt demand. From a different Bloomberg account:

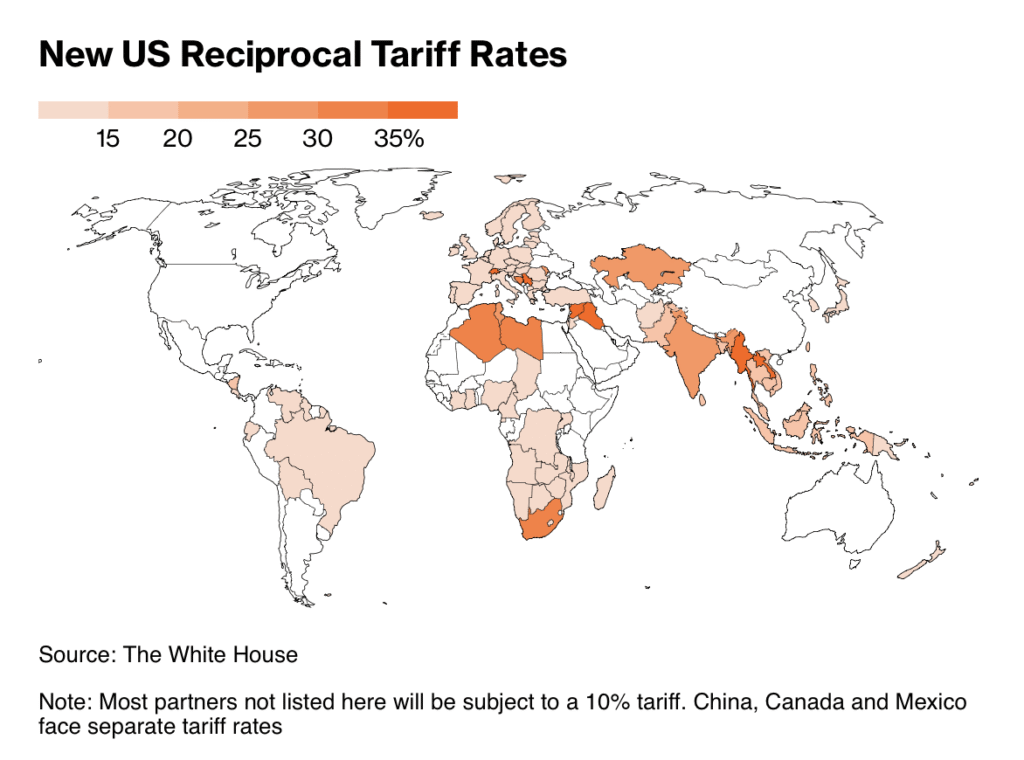

But at an average of 15%, the world is still facing some of the steepest US tariffs since the 1930s, roughly six times higher than they were a year ago. Trump’s latest volley outlined minimum 10% baseline levies, with rates of 15% or more for countries with trade surpluses with the US.

So far, the global economy has held up better than many economists expected after Trump’s initial tariff blitz. A rush to beat the elevated rates spurred a front-loading of exports, aiding many Asian economies and shielding US consumers from price spikes.

That could all be about to change.

“For the rest of the world, this is a serious demand shock,” Raghuram Rajan, former India central bank governor and chief economist of the International Monetary Fund, who is now a professor at the University of Chicago Booth School of Business, told Bloomberg TV on Friday. “You will see a lot of central banks contemplating cutting as the rest of the world slows somewhat in the face of these tariffs.”

In other words, in the US, the tariffs will increase stagflationary pressures. That view is confirmed by a report at CNBC:

The latest U.S. tariff policy is “still not the end of the story,” Stephen Brown, deputy chief North America economist at Capital Economics, said Friday.

“President Trump’s latest flurry of tariffs implies that the US effective tariff rate will rise to about 18%, from 2.3% last year,” he noted. That’s higher than expected and carries downside risks for global economic growth projections, as well as some upside risk for U.S. inflation forecasts, Brown said.

And with Jerome Powell having sat pat on interest rates, after Trump screamed for a cut, Trump will further increase pressure for the Fed chair’s ouster, which will only increase investor upset. But the odds are not trivial that Powell’s concern, of tariff-induced price increases, will be borne out in the next month or two. And as we have repeatedly pointed out, while a central bank’s interest rate increases can choke economic activity, it does not follow that putting money on sale provides a boost. Most businesses decide to expand operations based on conditions in their market, as in demand and competitor activities. The only enterprises where cheap money in and of itself might lead to incumbents to increase their activities are ones where the cost of money is one of their biggest expenses. Those are mainly financial institutions and financial speculators like real estate developers and hedgies.

Common Dreams has publicized a new way to get a better approximation of the real cost of Trump tariffs and other policy measures on household budgets, I hope some of you will road test it, and if is seems useful, encourage people you know, particularly in the press, in politics, or active in social media, to add it to their toolbox.

By Julia Conley, staff writer at Common Dreams. Originally published at Common Dreams

Six months into U.S. President Donald Trump’s second term, an economic justice group on Thursday unveiled an interactive tool to help Americans put a number on the unmistakable feeling many have reported having about the Republican leader who promised to “make America affordable again”: that costs have in fact gone up under Trump, and that the White House and the GOP are to blame.

Using the tool introduced by Unrig Our Economy, people across the U.S. can see exactly how much the price of essentials has gone up in their state, with the advocacy group connecting the dots between the rising cost of living and Trump’s tariffs as well as corporate tax breaks Republicans have relentlessly pushed to pass.

According to the “Don’t Inflate Our Plates” tool, the price of beef in Texas has gone up nearly 47% since the early days of Trump’s second term, while eggs cost $3.19 more than they did before Trump took office.

In California, eggs now cost over $5.00 more than they did before Trump’s second term, based on “historical trends, real-time supplier data, and market analysis” that Unrig Our Economy examined.

Trump & congressional Republicans claim that food prices will come down.

While they raise prices – we pay.

🚨So we built a brand-new site to hold them accountable:https://t.co/h3lVqz2Z6A tracks food prices in real time — and exposes how the GOP’s policies are raising costs. pic.twitter.com/YKvzMV683Z

— Unrig Our Economy (@UnrigOurEconomy) July 31, 2025

Unrig Our Economy gained some of its data from Kroger’s pricing data, finding that in states with Kroger stores, the price of beef has gone up between 16% and 72%, with the biggest price hikes in Alaska and Utah.

Egg prices in particular were a talking point for Trump during his presidential campaign, but they’ve risen in many states where Kroger operates, with customers in Michigan—where the president won in 2024—paying 58% more for eggs.

“Trump and Republicans in Congress are singlehandedly inflating the cost of everyday items that Americans rely on,” said Leor Tal, campaign director for Unrig Our Economy. “While billionaires and corporations cash in on Republican-backed tax breaks, working-class families are left paying higher prices for eggs, coffee, and more.”

Unrig Our Economy pointed to reporting on Trump’s tariffs, more of which are set to be announced Friday, with the president expected to impose rates up to 50% on some imports.

As Common Dreams reported this week, the advocacy group Groundwork Collaborative found that just as corporate executives used labor shortages and supply chain disruptions during the coronavirus pandemic as cover to keep prices high even after those problems were resolved, many are now using tariffs as a justification for price increases.

“We certainly welcome a reduction in the Chinese tariffs, but we’ll be announcing a price increase here regardless of any changes of the Chinese tariffs over the next week or two to go into effect in June,” the CEO of one footwear brand said in a recent earnings call.

Unrig Our Economy pointed to recent polling that showed Americans overwhelmingly disapprove of Trump’s tariffs, including 47% of Republican voters.

The Trump administration has also made a number of regulatory moves benefiting corporations that aim to take as much money from working families’ household budgets as possible, including a push for the cancellation of a Biden-era Federal Trade Commission rule allowing consumers to easily cancel subscriptions; the FTC’s decision to drop a lawsuit challenging price discrimination by PepsiCo; and the commission’s move shutting down public comments on corporate pricing tactics.

The interactive tool was unveiled weeks after the president signed into law his sweeping domestic policy and budget package, which includes the largest cuts to public programs like Medicaid and the Supplemental Nutrition Assistance Program in history, increases monthly payments for student loan borrowers under repayment assistance plans, and hands out $117 billion in tax cuts to the richest 1% of Americans while providing just $77 billion in cumulative savings to the bottom 60% of earners.

As Unrig Our Economy unveiled its tool allowing Americans to see exactly how their household budgets are being impacted under the Trump administration, the Century Foundation (TCF) and Morning Consult released the results of a poll in which they asked more than 2,000 people in June how they were being affected by the high cost of living over the past six months.

More than half of respondents said “billionaires, corporations, and congressional Republicans have made their lives harder,” and 60% said the Trump administration is to blame for the higher cost of living.

More than 4 in 5 Americans said they were concerned about the price of groceries, and nearly half were concerned about their ability to pay their rent or mortgage. Forty-eight percent said they would have difficulty paying an unexpected $500 bill, like a home repair or medical bill, without borrowing or using credit, and nearly 20% said it would be “very difficult” to make the payment.

Even among households with incomes over $100,000, more than a third said they would have a hard time meeting the surprise expense without dipping into savings or using credit cards—suggesting that these households are using a large proportion of their relatively comfortable monthly income for essentials

“While the federal government tears down programs such as Medicaid and food assistance and federal regulators give the green light to companies to rip off consumers, families are being forced to construct their own safety nets from a web of risky financial practices,” said TCF.

Unrig the Economy said that with Don’t Inflate Our Plates, the group is calling out “the Republican-backed policies that got us here” and demanding “that Congress put working people first.”